Margin Lending & Risk Management Technology - Some Concepts

Tuesday May 17, 2016

Being involved in the business of trading, risk and margin lending technology means hearing crazy new financial jargon every day. At least it keeps our job at PAC-INVEST a bit interesting.

I have been working on a technology project for a client recently, involving several margin lending and risk management concepts. After a bit of head bashing and a bit of burning of the proverbial midnight oil, I can finally say 'I get it'.

My short little jargon buster goes like this:

Loan Balance: The amount of money you can borrow from the bank. This is a static value once your loan is approved.

Security Value: The amount of money all your securities are worth on the market. This is a dynamic value and depends on the market price of those securities.

Buffer: The buffer is also a dynamic value depending on the security value, set by the Bank.

Total Security Value: Security Value plus Buffer.

Shortfall: the difference between the Loan Balance and the Total Security Value.

Margin Call Amount: The difference between Loan Balance and Security Value.

The arithmetical relationship follows:

Loan Balance = Shortfall + Total Security Value

Total Security Value = Security Value + Buffer

Shortfall = Loan Balance - Total Security Value = Margin Call Amount - Buffer

Margin Call Amount = Loan Balance - Security Value = Shortfall + Buffer

Following sections illustrate the concepts of the Margin Call and the Buffer Alert and also prove the old adage that a picture is worth a few thousand words (fine, call me lazy).

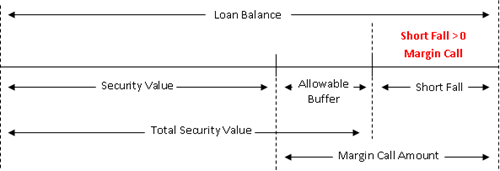

The Margin Call is defined as Shortfall > 0. We can see from the below diagram that the security value of this account is less than the loan balance at the moment. What makes it worse is that even though it is greater than 'plus the buffer' (the total security value), it is still less than the loan balance. This results in the Shortfall = Loan Balance - Total Security Value is greater than 0. So this account is under Margin Call.

Note: the Shortfall here is a positive value.

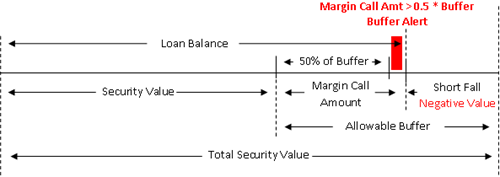

The Buffer Alert is defined as Margin Call Amount > Total Buffer Value * 0.5 AND Margin Call Amount < Total Buffer Value. This time, as we can see from the diagram, the security value is less than loan balance agian, but the total security value is still above the loan balance. So the Margin Call Amount = Loan Balance - Security Value is still within the buffer -- greater than the 50% of the buffer though. So, the account is not under Margin Call yet, but under the Buffer Alert.

Note: the Shortfall here is a negative value.

PAC-INVEST provide margin lending, trading and risk management development and systems support.

Copyright PAC-INVEST PTY LTD 2012